Certificate of Put Discover an excellent Cd Account On the internet

Posts

An individual is an entire-time worker if their work plan fits the fresh company’s standard full-time working arrangements. Do not matter the times your meant to hop out, but may maybe not get off, the usa because of a health problem or situation you to definitely emerged when you have been in the united states. If your intended to log off the us on the a certain go out is set according to the contract details and you may items. Such as, you happen to be able to introduce that you intended to get off if your objective to possess visiting the You will be accomplished throughout the a period that isn’t for a lengthy period so you can be considered your to the ample exposure test. Do not amount the occasions you’re in the united states for less than a day and you are inside transit anywhere between a few cities beyond your Us.

- Comprehend Aliens Expected to Receive Cruising or Deviation Permits, later on.

- The newest filing out of an application 8275 otherwise Form 8275-Roentgen, although not, will not be addressed as if the corporation submitted a plan UTP (Setting 1120).

- For every day otherwise fraction of 1 month the fresh go back try later, the brand new agency imposes a punishment of five percent of your unpaid tax unless of course the newest taxpayer can be realistic cause of later submitting.

- Duplicate Withholding – That have particular minimal exclusions, payers that are expected to withhold and you may remit copy withholding to the new Irs are necessary to withhold and you may remit on the FTB to your money acquired to help you California.

The new sailing or departure enable given beneath the criteria in this part is just to your certain deviation where it’s awarded. To get a certification away from conformity, you ought to go to a good TAC place of work no less than two weeks before leaving the us and you can document either Mode 2063 or Mode 1040-C and every other expected taxation statements which have perhaps not already been recorded. The brand new certificate is almost certainly not provided more than thirty day period prior to your hop out.

Genuine Citizens away from American Samoa or Puerto Rico

You will receive details about Form 2439, that you need to put on your own get back. For individuals who didn’t have an SSN (or ITIN) provided to your or before the due date of your own 2024 go back (in addition to extensions), you may not allege the child income tax borrowing from the bank for the both the brand-new or an amended income tax come back. However, you are in a position to allege an education credit beneath the following items.

When you should document/Very important dates

Basically, the newest teacher or professor must be in the us primarily to coach, lecture, show, otherwise engage in look. A substantial part of one to individuals day should be centered on those responsibilities. Arthur’s taxation liability, thus pay by phone casino sites , is bound so you can $2,918, the brand new income tax responsibility figured utilizing the taxation pact speed for the dividends. Your taxation accountability is the sum of the brand new taxation to your treaty income plus the tax for the nontreaty money, nonetheless it cannot be over the newest tax accountability decided because the if the taxation pact had not have been in impact. To determine income tax to your items of earnings susceptible to all the way down income tax pact prices, profile the fresh income tax on each independent item cash during the quicker price you to definitely pertains to one items beneath the pact. An entire text of private tax treaties is additionally offered at Internal revenue service.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties-A-to-Z.

If your mailing address is different from the long lasting physical address (for instance, you employ a PO Package), enter their permanent street address. The definition of mate is going to be comprehend as the sex-natural and comes with men inside a wedding that have an exact same-gender partner. For individuals who submit the come back that have lost profiles or missing records, we can not techniques it and you will getting at the mercy of punishment and focus.

Rent Guidance

- See Desk one in the new Taxation Treaty Tables, offered by Internal revenue service.gov/TreatyTables, for a listing of taxation treaties you to definitely excused You.S. social protection advantages from U.S. taxation.

- Partnered twin-position aliens can also be allege the credit only if it choose to document a joint come back, because the chatted about within the chapter step one, or if they be considered because the certain hitched people lifestyle apart.

- All of the liberties arranged.The Neighbourhood Credit Connection (YNCU) is actually an authorized credit partnership doing work inside the, and you can under the laws and regulations out of, the brand new state from Ontario.

- The relationship will give you a statement for the Mode 8805 showing the new tax withheld.

Legislation brings punishment to have failure to help you document output otherwise shell out fees as needed. You’re needed to document suggestions production to help you report particular foreign income or possessions, or monetary transactions. While you are a stockholder inside the a mutual finance (or other RIC) otherwise REIT, you might allege a cards for your display of any fees repaid from the organization on the its undistributed a lot of time-label financing progress.

Where you should File

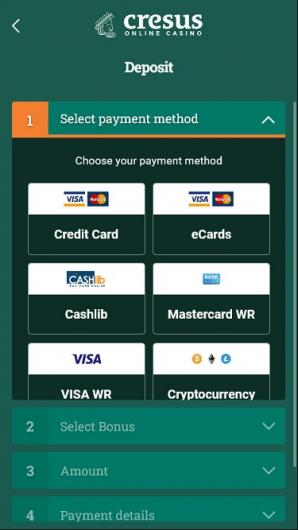

Very few gambling on line internet sites render great no deposit casino bonuses. Lately just about every online casino website transformed to the deposit bonuses or deposit & rating options. Yet not, here at BonusFinder we try for the best no-deposit incentives and you will choices.

Line 76 – Child Tax Borrowing from the bank (YCTC)

Rating form FTB 3805P, Additional Fees for the Certified Preparations (and IRAs) and other Income tax-Best Profile. If required in order to declaration additional income tax, declaration they online 63 and you may generate “FTB 3805P” left of your count. If the man is actually married/otherwise an enthusiastic RDP, you need to be eligible to claim a depending exclusion borrowing from the bank to own the kid. RDPs just who document a ca tax get back while the married/RDP processing as one and now have zero RDP alterations ranging from government and Ca, combine the personal AGIs from their government tax statements registered which have the brand new Irs. Reference their finished government income tax go back to complete which part.

When the pleased with all the information, the new Irs will establish the level of their tentative taxation for the tax seasons on the gross income efficiently related to their trade or organization in the united states. Ordinary and you can expected company costs will likely be taken into consideration if the known to the brand new pleasure of your Commissioner or Administrator’s delegate. Nonresident aliens who’re bona-fide owners of your own U.S Virgin Islands are not susceptible to withholding of U.S. income tax to your money attained if you are briefly doing work in the us.

This method is applicable an everyday periodic rates for the dominant inside the brand new membership every day. Speed advice – The pace on your own membership is NaN% having an annual Percentage Produce out of NaN. The interest cost and you can yearly percentage efficiency are varying that will change any moment during the our very own discernment. Delight understand that when you fill out an application, discover a free account, otherwise play with all of our services, you commit to become limited by these types of terms. Payments of U.S. taxation should be remitted to your Irs inside You.S. bucks. Visit Irs.gov/Payments for here is how making a payment having fun with any of one’s following the choices.

The newest property owner will costs clean up charges in addition assessed damage can cost you. While the a property manager, security deposits render a back-up when you’re renting aside a property. Although not, the procedure of gathering deposits and handling faithful accounts can cause a demanding workload, compelling of a lot landlords to look at defense deposit options one remove administrative weight. Its platform can also be automate the fresh computation of great interest, inform costs for long-identity clients, and make certain accurate symbolization out of accrued focus on the membership comments.